Lines out the door and around the building of gun stores. Empty shelves of germ killing household cleaners. Alcohol sales at all time highs. Welcome to the Guns, Germs and Beer Economy. It is phase one in a four phase transition of our economy. Are you ready for each phase?

This article borrows its title from the Pulitzer Prize winning book Guns, Germs and Steel, in which Jared Diamond argues that our advantages are a product of our environment — and these advantages have compounding effects. Over time, populations/states diverge because of these compounding advantages. Diamond chalks up differences in wealth among populations to geographical drivers going back thousands of years.

Where I differ from Diamond is that I believe there are fateful choices along the journey. Europeans, Chinese and Americans can all point to numerous fateful choices. Here are a few examples of where the choice between looking backward versus looking forward defined economic development for decades.

- Venetian’s focus on the profitable trade around the Mediterranean in the 1400s led them to miss the opportunity the Spanish, Portuguese, Dutch, French, English and others sought across the Atlantic.

- The decision of China, in 1525 to burn their world class fleet of ships and turn inward influenced their trajectory for hundreds of years.

- More recently, Mao’s Great Leap Forward was anything but a leap forward. It was a ruinous backward looking agrarian vision that was incompatible with where future economic opportunities would be found. China would not be the economic powerhouse it is today if it had stayed on this course. In 1978 China made a choice to change direction and move toward a mixed capitalist and planned economy and it has generated compounding growth over the last forty years.

- For the US, our initial choice after World War II with the Morgenthau Plan tried to roll-back the clock and return Germany to an agrarian economy. It had destructive implications for Germany and Europe. The Marshall Plan offered a different choice. It focused on building a modernized industrial economy with increased productivity. It wasn’t until the US changed course in 1948 with the Marshall plan that we set Europe and the US on a path of compounding advantages.

- In the last few years, China made a strategic decision to focus on AI. As Kai-Fu Lee explains in his book AI Superpowers, China is focused on winning the AI Arms race. China’s leaders believe this AI will be a source of compounding advantages for many years to come.

The COVID moment is upon us. What are the choices we are making to ensure we chose a path for compounding advantages in a post COVID-19 world?

We will return to this question after we take a look at the four phases of the COVID economy.

Phase 1:

In Phase 1, the products that are booming are the ones that people perceive as adding to their safety, or fight invisible germs (at home or for health care workers), or give us a bit of a break from stress.

With kids at home all day, puzzles and hobby project kits have sold well. Stay at home products for the active (fitness equipment) to the less active (streaming services) to the interactive (VR video games) have grown in sales. Products that help us keep working from home have also done well. At the same time products and services requiring an in-person social component are suffering. Sit-down restaurants, live entertainment (sports, concerts and shows), movie theaters and retail shopping are down to levels thought impossible just six months ago. All things travel and tourism are devastated.

Here are some data points to characterize Phase 1:

- 2million guns sold in the US — The FBI conducted 3.7m background checks in March 2020, the highest total since the instant background check program began in 1998.

- Premium toilet paper sales increased 379%

- Powdered milk, up 375%

- Chlorine bleach, up 340%

- Dry, hearty soups, up 235%

- Deodorant soap bars, up 218%

- Canned wines were up by 95%

- Three-liter boxed wines were up by 53%

- The 36-pack beer were up 40%

Declines in Phase 1:

- 90% decline in air travel

- 27% decline in new auto sales

- 72% drop in Auto Dealer foot traffic since February 3rd to April 12th.

- Movie Theaters: 97% drop in foot traffic

- Shopping Malls: 94% drop in foot traffic

Phase 2:

Phase 2 is the time period after the initial peak but before we have a vaccine, or therapeutics that significantly reduce the risk of hospitalization or death, is just starting. During Phase 2, the carpet can be pulled out from under economic recovery if there is an accelerating rate of COVID infection, hospitalizations or deaths. The recovery will be tenuous and uneven. Supply chain disruptions that emerged during Phase 1 will become more obvious, especially in food production.

In food production, a large portion of supply is channeled to restaurants and institutions, and is not easily re-packaged for retail. USDA should take up the purchasing slack to help the food bank system and farmers, but was slow to act during Phase 1. Supply chains will remain fragile, especially for complex production, where a single part can hold up production.

Consumer spending will cautiously return. Personal care such as hair salons, dentists and optometrists will work to catch up with pent up demand, but many service industries related to travel and tourism will not return quickly. The shift to online ordering will endure, albeit at less than its peak in phase 1. Millions of service workers will remain under-employed or unemployed. Auto sales and other durables will have a slow recovery as consumers are cautious in their spending. Those that have money to spend will seek deals for non-essentials with a glut of supply and will bid prices up creating some inflationary pressure for those items in short supply.

Here are some data points to characterize Phase 2:

- According to IPSOS, 49% of consumer say they are spending less. Only 16% say they are spending more.

- According to Within Retail Pulse, “The stimulus packages that Americans are receiving has shown immediate, positive impact reflected in brands’ on-site sales and revenue metrics. The performance spikes are near what many usually see over Black Friday or Cyber Monday.”

Yet, some items may become increasingly difficult to find given supply chain problems: :

- Beef harvest is about 20% lower than a normal week. Harvest is expected to be even lower this week according to analysts.

- For week ending April 17, the USDA estimated hog slaughter was 2.236MM hogs, roughly 7% lower than previous week and 6% lower than the same week last year.

- According to US Foods, “...there have been multiple protein plants temporarily shut down or running at some percentage of full capacity due to the pandemic. Coupling this information with the low harvest numbers, the sense among analysts is that supplies will be tight over the next few weeks, leading to higher prices.”

Business will make bets on distribution channels and will attempt to retool. Taylor Farms, for example, serves both retail and institutions with their salad supply. They made a bet on retail in March and re-oriented their production accordingly. Others that produce exclusively for institutions don’t have the same ability to re-orient their production. Some have tilled under hundreds of millions of dollars worth of produce, or dumped milk, or destroyed animals. They are unlikely to invest as much in the next crop, herd or flock given the loss of profits they are experiencing now and uncertainty in their distribution channel.

At the same time, lines at food banks run into the hours of wait time. The USDA, the traditional bulk buyer for school lunch programs and food banks has been slow to adjust, even though China showed a pretty clear future of food supply disruptions back in February. As the Economist covered the story, the Chinese government cut red-tape associated with everything farm related and put out a call for a second planting as they anticipated a tight supply after food rotted in the supply chain.

Re-aligning food channels isn't trivial. Consider Henning's Cheeese in Wisconsin. Their cheese wheels ship on their own pallet and can weigh up to 4,500 lbs. It just doesn't fit in a consumers refrigerator, and re-orienting production for the retail consumer market takes time. The US is watching a rerun of the episode that played out in China two months earlier. If the US handles it well, this could create opportunities for US farmers, but it could also create supply shortages if distribution adjustments are not made quickly. Phase 2 is the period with greatest geopolitical instability as food channel re-alignment will be a challenge every economy around the globe will face, and is the issue most likely to lead to civil unrest if handled poorly.

Phase 3:

Phase 3 will start somewhere in 2021 and move into full swing in 2022, after we have effective immunity from a vaccine or effective therapeutics that cut the fatality rate and hospitalization rate down significantly, herd immunity lowering the rate of spread significantly, or a surrender to an inability to control COVID.

Phase 3 will be the first true opportunity to normalize the economic growth cycle. In Phase 3 the different approaches to stimulus will show some signs in the shape of the recovery, but like with the early stages of exponential growth, Phase 3 recovery will look deceptively similar across different economies. In other words, it won't be immediately obvious that some economies are set on a completely different trajectory than others due to the types of investments they made in 2020 and 2021.

Recovery might at first appear like that of great recession, but underneath the trend are compounding advantages that will differentiate winners and losers for a decade or more. A return to "normal" in this phase should be viewed with some skepticism, in much the same way a post World War II return to an agrarian economy was a step backwards. For example, China recently approved a record number of coal fired power plants. That is a backward move that will hurt them in the longer-run.

Phase 3 is a fork in the road. One path is to prop up mature industries with very little growth and a lot of legacy baggage. The other path is propelling forward technologies and industries that were already showing success, albeit in the early stages of growth. Singularity University Guides and World Economic Forum/Fourth Industrial Revolution are a great places to look for specific examples. For example, is it a better long-term bet to stimulate more coal production, knowing it was on the decline even before COVID, or to stimulate clean energy adoption? Suffice it to say, smart stimulus to accelerate adoption of 4th Industrial Revolution Technology will pay dividends in Phase 4.

Phase 4:

Phase 4 is our growth economy after the COVID recovery, where early investments in key growth areas will define the winners. The expansion should last a decade, and therefore will resort the list of top global economies. At the top of the list will be those countries that used Phase 2 and Phase 3 to stimulate for the industries of the future rather than prop up inefficiencies of the past economy. What will be different about this expansion is that it is will follow a global pandemic that simultaneously shut everything down, and requires a staggered return to work.

This recovery will be unusual in a few respects. First, the response to COVID created the fastest unemployment shock ever experienced. In the US, in under 45 days, 26 million people were put out of work. Second, because COVID is not extinguished, there will be a Phase 2 limbo period where society will not want everyone going back to work ASAP. If you work in live entertainment, such as selling hot dogs at a ball park, for example, work isn't going to go back to "normal" until we hit Phase 3. Therefore, how we turn Phase 2 into an springboard for better growth in Phase 4 will be important.

Five Choices We Can Make For A Better Post-COVID Economic Expansion

Given the unique circumstances of this recession and recovery, here are five ideas you should consider. Share with your elected officials the ideas you think have the most merit.

1. A COVID GI Bill

Implement a GI Bill of sorts. Like in the aftermath of WWII, with millions of GIs looking to return to work, the US Government eased the transition by offering all those that would take it paid for education and vocational training. Given how badly the US botched integration after WWI, this was vast improvement. The GI Bill upgraded the skill set of the country and allowed for a more gradual integration of the GIs back into the workforce. It is credited with creating a strong middle class and enhancing a sense of reciprocal civic duty.

Why not develop something similar for the millions of service workers that generally don't get paid very well and could use an education or vocational skill upgrade?

2. High Tech Manufacturing

There are many high-tech manufacturing advances including 3D printing and automation. The promise is to bring manufacturing closer to customers, reducing transportation and the fragility of complex supply chains. Tesla's Gigafactory 1, in Nevada, provided insights into the type of jobs required to run a modern high tech manufacturing in the US. The US Government was encouraging high tech manufacturing clusters in the US through a grant program. Why not expand the program significantly and connect it to the COVID GI Bill to support higher education and vocational training for the millions of displaced workers that want to build?

3. Energy

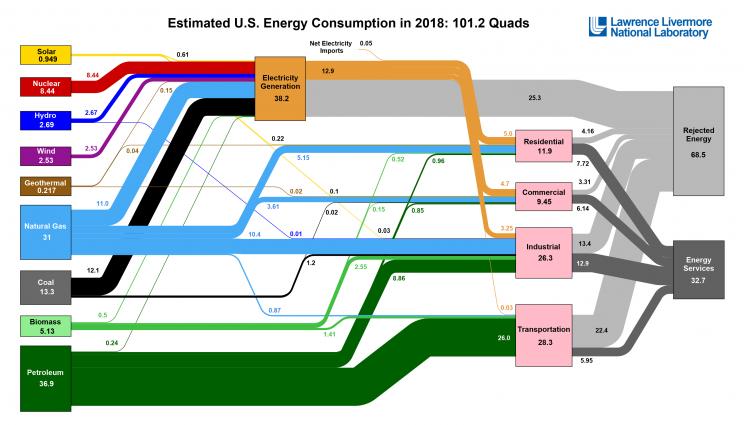

Lawrence Livermore National Laboratory produces an annual energy consumption chart and trends analysis. What is fascinating about the chart is how much energy is lost to old inefficient process. They refer to it as "rejected energy." Coal, for example, wastes over 80% of energy in production, with a small percent actually getting to end users.

Battery storage paired with solar and wind became a more cost efficient solution compared to constructing another in-efficient coal plant. But, as electrek observes in their analysis of National Laboratory chart, they have a long way to go. In my work with energy utilities in the US, I have seen a strong appetite for building community solar and supporting the electrification of our cars. Why not accelerate this trend?

4. Cash for Clunkers, the EV Edition

In the last recession, the cash for clunkers helped America trade-in their gas guzzlers for more efficient and cleaner new cars. I for one appreciate the cleaner air and would hope a new cash for clunkers would add additional incentives for Americans to consider electric vehicles. There are some great American EV vehicles from Tesla as well as Rivian, Ford (check out the Mach-e) and GM (how about that new all electric hummer!). Given the link between health problems and air quality, moving the US toward less pollution will pay off in the long run.

5. Data Analytics Infrastructure

There are many examples of data and technology making our business and industrial processes more efficient. I've seen AI drones to check power lines and predict which power poles needed maintenance (see eSmart System. I have seen manufacturing processes made more efficient (see TO Falkonry). In my own industry, I've seen how AI is transforming business analytics (see Research World article). But at the same time, I see governments in the US unable to report on hospitalizations. Unable to effectively trace cases. An Electronic Death Reporting System (EDRS) isn't even close to where it is supposed to be (see Inspector General's report). We have a long way to go.

At the same time, China is is pressing the gas on data analytics. For education, they have facial recognition AI that automatically codes the level of engagement of the student with the material. This may be a dystopia or it may truly help children get the support they need to learn. To the extent that data analytics can improve outcomes and increase efficiency, the technology adoption will be a differentiator between economies that grow faster or slower in Phase 4. My sense is that we need to be running a lot harder and faster in this area if we want to have a shot at accelerated growth in Phase 4.

Take Action

These are just five ideas. The litmus test for our investments in the economy during this downturn is for a recovery that will produce compounding future advantages. Failure would be simply trying to restore what once was — that would be looking backward. I hope you will look-up your congress person, senator and state representatives and send a brief note about what strategic moves you'd like to see as they budget for COVID-19 recovery. Whether you send your representative a link to these ideas, or others, please take a moment to make your voice heard. It takes only a few minutes, and can pay dividends for years to come.

What ideas would you add? Share them in the LinkedIn Comments to this article.